Get the free texas revocable living trust pdf

Show details

REVOCABLE LIVING TRUST Q TIP TRUST FORM I Peter Miller Residing at 1287 Pine Avenue Dallas County of Las Collinas State of Texas Herein referred to as Grantor hereby transfer to George Summerlin. 6765 Park Avenue Houston Texas hereinafter called the Trustee As Trustee the property set forth on Schedule A attached hereto and made a part hereof to be held IN TRUST for the purposes and in accordance with the provisions which follow ARTICLE I Lifetime Benefits Prior to my death my Trustee shall 1...

We are not affiliated with any brand or entity on this form

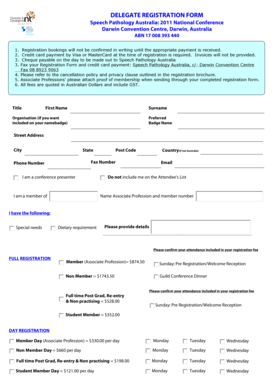

Get, Create, Make and Sign texas living trust form pdf

Edit your living trust forms texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a texas revocable living trust transfer of assets to beneficiaries form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing living trust texas template online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit texas living trust form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out living trust sample pdf form

How to fill out Texas revocable living trust:

01

Obtain the necessary documents: Start by obtaining the Texas revocable living trust form or template. This can be obtained online or through an attorney specializing in estate planning.

02

Personal information: Fill in your personal information such as your full name, date of birth, and address. You may also need to provide the names of your beneficiaries.

03

Appoint a trustee: Choose a reliable individual or institution to serve as the trustee of your trust. This person will be responsible for managing the trust assets and distributing them according to your wishes.

04

Determine the trust property: Identify the assets that you intend to transfer to the trust. This could include real estate, bank accounts, investments, and personal property.

05

Name beneficiaries: Specify who will receive the trust assets upon your passing. You can name individuals, charities, or even create provisions for future generations.

06

Specify distribution instructions: Provide instructions on how the trust assets should be distributed to the beneficiaries. You can choose to distribute the assets in a lump sum or in periodic installments.

07

Sign and notarize the document: Once you have completed all the necessary sections, sign the trust document in the presence of a notary public. This will ensure its validity and enforceability.

08

Fund the trust: To make the trust effective, you must transfer the ownership of the identified assets to the trust. This should be done by updating the titles and ownership documents accordingly.

09

Keep the trust updated: As circumstances change, review and update the trust regularly. Consult with an attorney to ensure that your trust remains aligned with your wishes and meets any new legal requirements.

Who needs Texas revocable living trust?

01

Individuals with significant assets: If you have substantial assets, including real estate, investments, or business interests, a revocable living trust can help streamline the management and distribution of these assets.

02

Individuals concerned about privacy: Unlike a will, a revocable living trust avoids probate, which is a public process. By using a trust, you can keep the details of your estate private.

03

Individuals with complex family situations: If you have dependents, blended families, or beneficiaries with special needs, a revocable living trust can provide more customized and comprehensive instructions for the distribution of your assets.

04

Individuals who desire flexibility: Revocable living trusts can be amended or revoked during your lifetime, allowing you to make changes as your circumstances evolve.

05

Individuals looking to avoid conservatorship: A revocable living trust can appoint a trustee to manage your assets if you become incapacitated, avoiding the need for court-appointed conservatorship.

Fill

revocable living trust texas forms

: Try Risk Free

People Also Ask about living trust in texas form

What are the disadvantages of revocable living trusts?

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

Are trusts recorded in Texas?

Wills must go through probate and become public record. A trust is not probated and does not become public record. Your beneficiaries, assets, and trust terms remain private. Trusts are also more difficult to contest than wills, providing greater security.

How do I set up a revocable living trust in Texas?

If you would like to create a living trust in Texas you will need to sign a written trust document before a notary public. The trust is not effective until you transfer ownership of assets to it. A living trust offers options that may be beneficial to you as you plan for the future.

What makes a trust valid in Texas?

Under Texas trust laws, the following are required for a valid trust to be formed: The Settlor must have a present intent to create a trust. The Settlor must have capacity to convey assets to the trust. The trust must comply with the Statute of Frauds.

Does your trust need to be registered?

For taxable trusts created on or after 6 April 2021, the trustees have had to register the trust within 90 days of becoming liable for tax or 1 September 2022 – whichever is later. Different registration deadlines applied for taxable trusts created before 6 April 2021.

How do I file a living trust in Texas?

To make a living trust in Texas, you: Choose between establishing an individual or shared trust. Determine which assets will be included in the trust. Select a successor trustee. Determine the trust's beneficiaries or those who will receive the trust's assets. Create the trust document.

Does a revocable living trust need to be recorded in Texas?

Unlike a corporation, which is required to file a certificate of formation with the Secretary of State, there is no such requirement for a trust. Rather, the trust remains a private document.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the living trust forms form on my smartphone?

Use the pdfFiller mobile app to complete and sign texas living trust forms on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit texas revocable living trust template on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute revocable living trust template from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out texas revocable living trust form on an Android device?

On Android, use the pdfFiller mobile app to finish your living trust form texas. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is texas revocable living trust?

A Texas revocable living trust is a legal document that allows an individual to place their assets into a trust during their lifetime, which can be altered or revoked at any time. It is designed to manage the individual's assets and ensure they are distributed according to their wishes upon death.

Who is required to file texas revocable living trust?

Typically, no one is required to file a Texas revocable living trust since it is a private document. However, it may need to be presented to the court or relevant parties upon the grantor's death or if the trust becomes irrevocable.

How to fill out texas revocable living trust?

To fill out a Texas revocable living trust, one must first gather information about their assets, choose a trustee, outline the terms of the trust, and then complete the trust document, ensuring it complies with Texas laws. It is advisable to consult with an attorney for proper drafting.

What is the purpose of texas revocable living trust?

The purpose of a Texas revocable living trust is to facilitate the management and distribution of assets during the grantor's lifetime and after death, avoid probate, protect privacy, and allow for the seamless transfer of assets to beneficiaries.

What information must be reported on texas revocable living trust?

Information that must be reported in a Texas revocable living trust generally includes the names of the grantor and trustee, a detailed list of the assets placed in the trust, instructions on how the assets are to be managed and distributed, and any specific conditions or wishes of the grantor regarding the trust.

Fill out your texas revocable living trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Living Trust Template is not the form you're looking for?Search for another form here.

Keywords relevant to living trust form

Related to texas revocable trust form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.